Top Searches

Last 30 days

mba

49

mb

43

110373741

20

1103737415

16

10938727904

15

phim sẽ

15

11037374157

14

1103737

12

110

10

11

10

11037

10

1103

10

{search_term_string}

9

phim dẽ

7

robots.txt

7

เแ่ึกั

6

ff

6

roblox

6

phim

6

ro

5

phi

4

rob

4

99 nights in the forest

3

100000000000000000000000000000000

3

robl

3

roblo

3

phim de

3

99

2

josué,

2

steal a brain

2

steal a bra

2

steal

2

105

2

robu

2

spin wheel

2

◌ั◌ิร้ีดเ32222.

2

sub

2

500

2

indian bike 3d

2

99 nights in the

1

Based on recent search activity from our community

Popular Tags

From top games

Jumping

1

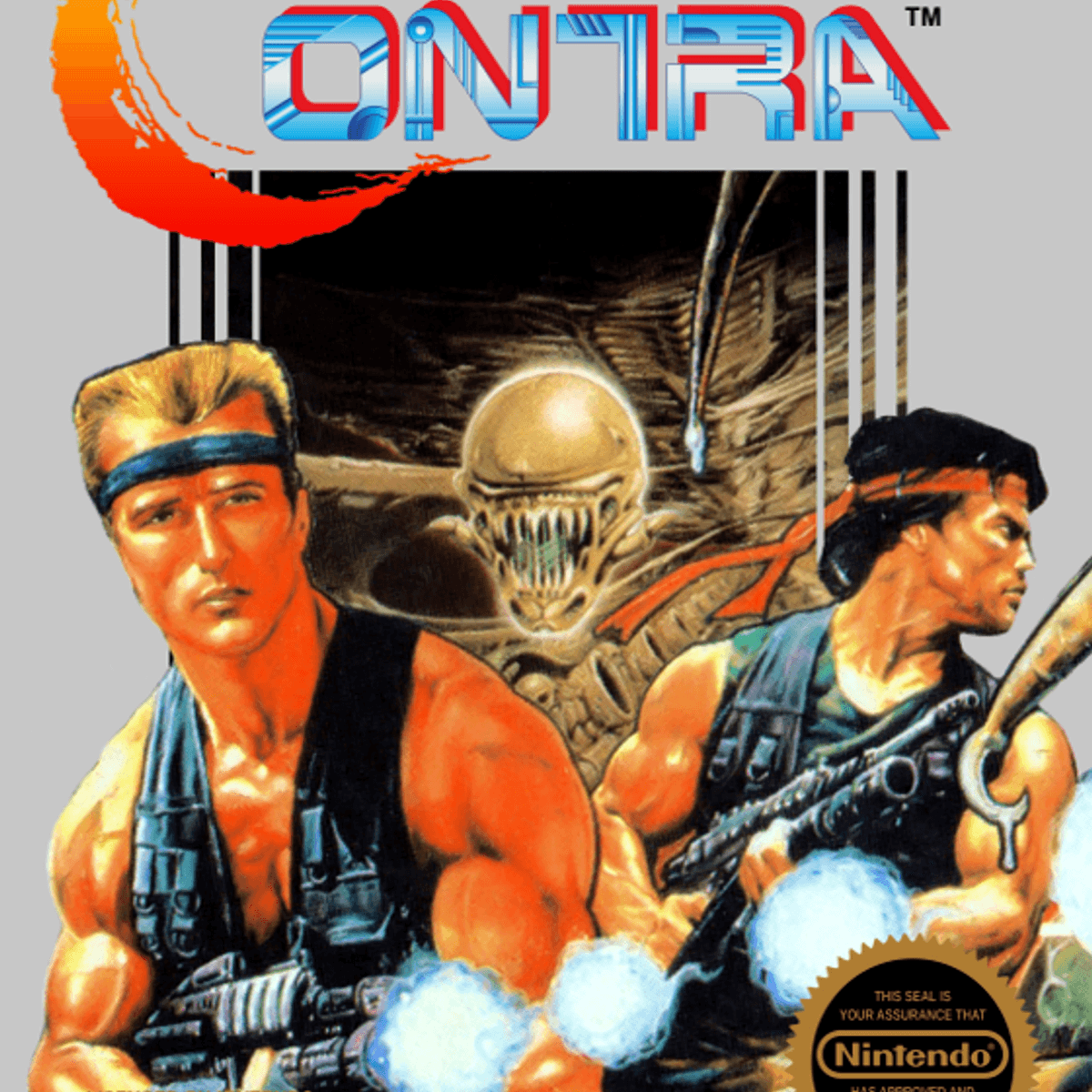

Action

130

Adventure

127

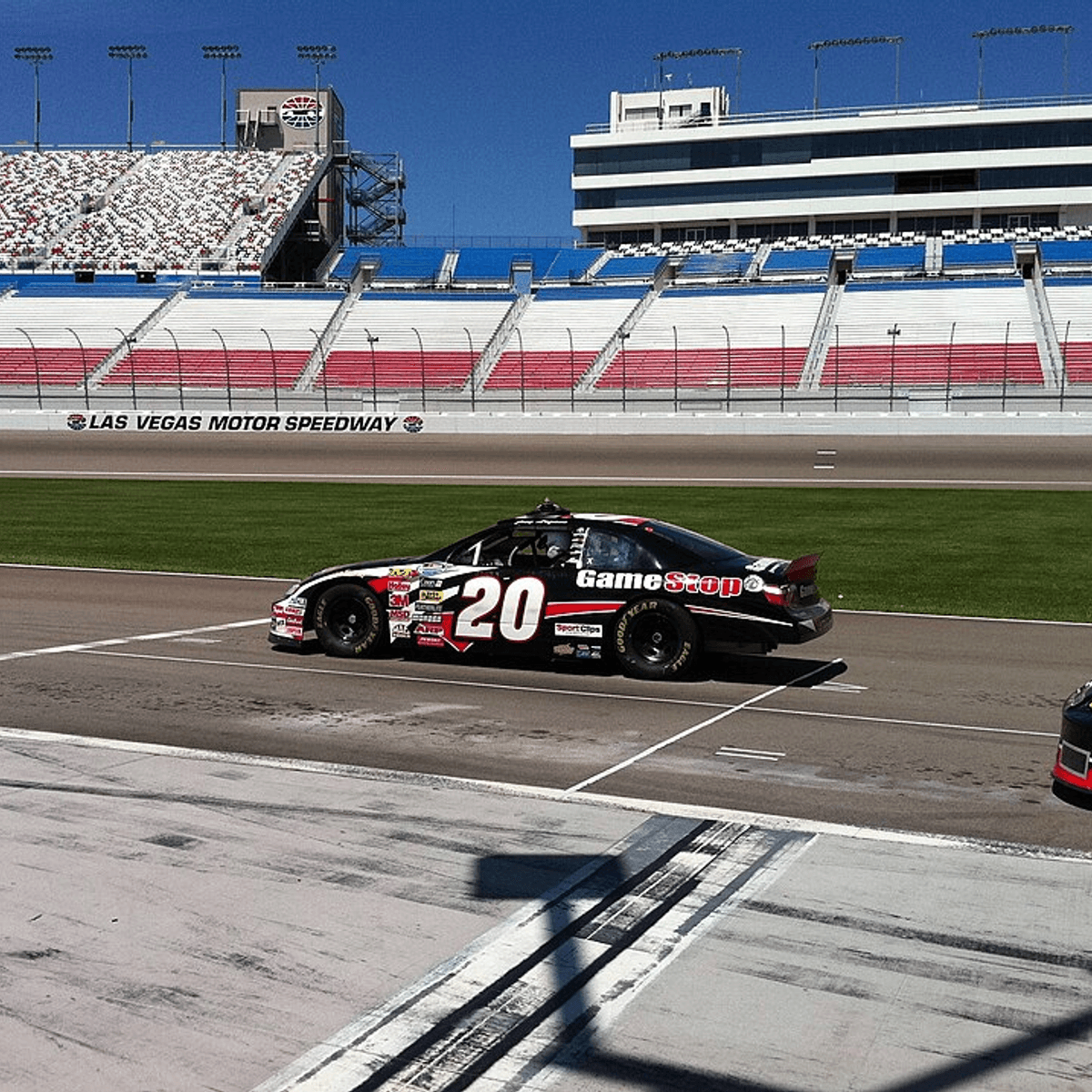

Racing

116

Puzzle

110

Fighting

2

Anime

3

Retro

13

Brawler

3

Superhero

3

Pixelart

2

Arcade

15

Based on tags from highly rated and popular games

Discover Games

Hand-picked games for every taste

Hall of Fame

Top Players by Experience

2

Nipam

Runner Up

Level 2

2

1

369

Champion

Level 3

1

3

Nipam

Third Place

Level 1

3

2

Nipam

Runner Up

2

1

369

Champion

1

3

Nipam

Third Place

3

1

369

Champion

Level 3

#1

452 EXP

2

Nipam

Runner Up

Level 2

#2

150 EXP

3

Nipam

Third Place

Level 1

#3

25 EXP

The Ultimate Gaming Experience

Join thousands of players in our premium arcade platform featuring the latest games and timeless classics.

![Galaga [h1]](/uploads/images/games/galaga-h1/thumbnail/galaga-h1.png)

![Turbo Outrun (JUE) [h1]](/uploads/images/games/turbo-outrun-(jue)-[h1]/thumbnail/turbo-outrun-(jue)-[h1].png)

![Turbo Outrun (JUE) [h1]](/uploads/images/games/turbo-outrun-(jue)-[h1]/large/turbo-outrun-(jue)-[h1].png)