Project finance plays a crucial role in funding large-scale infrastructure and industrial projects in emerging markets. These markets present exciting opportunities for investors, as they offer potential for high returns and immense growth. However, they also come with their own set of challenges, including political and regulatory uncertainties, weak institutions, and limited access to capital. Understanding project finance in the context of emerging markets is essential for navigating these challenges and maximizing the opportunities they present.

In this article, we will explore the concept of project finance and how it differs from traditional corporate finance. We will delve into the financial structure and various funding sources commonly used in project finance. Additionally, we will discuss the key players involved in project finance, including project companies, lenders, borrowers, shareholders, and financial institutions.

Cash flow is a critical aspect of project finance, and we will examine its importance in ensuring timely repayment. We will also explore different types of project finance, such as recourse, non-recourse, and limited recourse financing, as well as the concept of off-balance-sheet financing.

The structure of project finance involves the use of special purpose vehicles (SPVs) and financial modeling to assess the project’s financial feasibility. We will discuss the role of project cash flow in this process and compare project finance to corporate finance, highlighting their differences and implications on financial statements.

Risks are inherent in project finance, and we will examine the various risks associated with these types of investments. Long-term projects, the construction phase, and funding needs will be analyzed in detail.

Furthermore, we will explore different funding methods in project finance, including debt and equity financing, as well as structured financing options like take-or-pay and off-take agreements.

Project finance in emerging markets presents its own unique considerations and challenges. We will discuss the specific opportunities and obstacles associated with financing infrastructure and industrial projects in these markets, including procurement and construction considerations.

Lastly, we will provide case studies that highlight successful project finance examples in various industries, such as infrastructure financing, power purchase agreements, and oil and gas projects. These case studies will offer practical insights into real-world project finance scenarios.

In conclusion, project finance in emerging markets presents both opportunities and challenges for investors. By understanding the intricacies of project finance and the specific considerations in these markets, informed investment decisions can be made. It is crucial to conduct comprehensive risk assessment and financial feasibility analysis to ensure successful project execution and achieve desired returns.

Key Takeaways:

- Project finance plays a crucial role in funding infrastructure and industrial projects in emerging markets.

- Emerging markets offer attractive investment opportunities but also come with challenges such as political and regulatory uncertainties.

- Understanding the financial structure and funding sources in project finance is essential.

- Cash flow and repayment are vital aspects of project finance.

- Different types of project finance, including recourse and non-recourse financing, have their advantages and implications.

Understanding Project Finance

Project finance is a specialized field within the broader realm of corporate finance. While corporate finance focuses on the overall financial operations of a company, project finance specifically deals with the financing of large-scale projects, such as infrastructure and industrial projects. In this section, we will explore the concept of project finance and its unique characteristics.

One of the key distinctions between project finance and corporate finance is the financial structure. In corporate finance, the overall financial health of the company, including its assets and liabilities, is taken into account. On the other hand, project finance involves creating a separate financial structure specifically for the project at hand. This allows for the efficient allocation of risks and rewards associated with the project, without affecting the financial standing of the sponsoring company.

When it comes to funding sources, project finance relies on a variety of options. These may include equity investments, debt financing, and off-balance-sheet financing. Equity investments involve stakeholders providing capital in exchange for a share of the project’s ownership and future profits. Debt financing, on the other hand, involves borrowing money from lenders with the promise of repayment over a specified period. Off-balance-sheet financing refers to financial arrangements that are not recorded on the company’s balance sheet, such as through leasing agreements or special purpose vehicles.

Project finance allows companies to undertake large-scale projects without putting undue strain on their existing balance sheets. By leveraging various funding sources, project finance provides companies with a flexible and efficient way to secure the necessary capital for their projects.

To illustrate the importance of project finance, let’s consider an example. ABC Corporation plans to construct a new power plant that requires a significant amount of capital investment. Through project finance, ABC Corporation can secure funding specifically for the power plant project, ensuring that the financial risks associated with the project are isolated from the rest of the company’s operations.

Project finance plays a crucial role in driving economic development, particularly in emerging markets. By attracting investment for infrastructure projects and industrial initiatives, project finance helps stimulate growth and create employment opportunities. As a result, it is essential for businesses and financial institutions to understand and leverage project finance to navigate the complex landscape of funding large-scale projects.

Example of Funding Structure in Project Finance

To better understand the financial structure in project finance, let’s take a look at a simplified example:

| Funding Source | Percentage |

|---|---|

| Equity Investment | 30% |

| Debt Financing | 40% |

| Off-Balance-Sheet Financing | 30% |

In this example, the project is funded by a combination of equity investment, debt financing, and off-balance-sheet financing. The proportions represent the percentage of each funding source relative to the total project cost. This diversified funding structure allows for a comprehensive capital arrangement that reduces the financial risks associated with the project.

Key Players in Project Finance

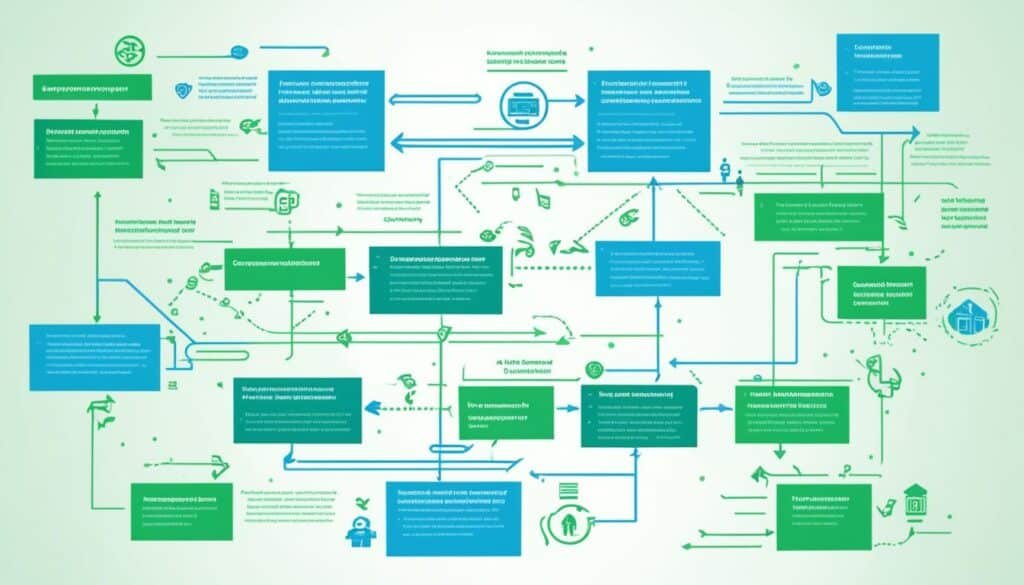

Project finance involves a complex network of key players who contribute to the success of a project. These players include the project company, lenders, borrowers, shareholders, and financial institutions. Each party plays a vital role in the financing process, ensuring that projects are adequately funded and executed.

The project company is responsible for initiating and managing the project. It may be a special purpose vehicle (SPV) created solely for the purpose of executing the project. The project company collaborates with various stakeholders, such as contractors and suppliers, to ensure the smooth execution of the project.

Lenders are the financial institutions or individuals that provide the necessary funding for the project. They carefully assess the project’s financial viability and risks before deciding on the loan amount and terms. Lenders may include commercial banks, development finance institutions, or private investors seeking viable investment opportunities.

Borrowers are the entities or individuals who receive the funds from lenders to finance the project. Borrowers may be the project company itself or other parties directly involved in the project, such as contractors or government entities. They are responsible for repaying the loan according to the agreed-upon terms.

Shareholders are individuals or entities that own shares in the project company. They provide equity financing and have a stake in the project’s success. Shareholders may include private investors, institutional investors, or the project company’s founders. They share the financial risks and rewards associated with the project.

Financial institutions play a crucial role in project finance by providing various financial services such as advisory, underwriting, and risk management. These institutions may include investment banks, insurance companies, and asset management firms. They facilitate the flow of funds and provide expertise in navigating the complex financial landscape of project finance.

In summary, successful project finance requires the collaboration and expertise of multiple key players, including the project company, lenders, borrowers, shareholders, and financial institutions. Their collective efforts ensure the efficient allocation of funds and the successful execution of infrastructure and industrial projects.

Cash Flow and Repayment

In project finance, cash flow plays a critical role in ensuring the successful repayment of project debt to creditors. A well-managed cash flow is essential for meeting financial obligations and maintaining the project’s financial stability.

The creditor, or lender, is a key player in project finance who provides the necessary funds for the project. They expect timely repayment of the borrowed amount, along with interest, which is typically structured based on the project’s expected revenue stream.

The revenue stream serves as the primary source of funds for repayment. It encompasses the project’s income generated from operations, such as sales, lease payments, or service fees. Reliable and sustainable revenue streams are crucial for meeting repayment obligations and ensuring the project’s long-term financial viability.

Effective management of cash flow is vital for meeting repayment obligations and maintaining the financial stability of the project.

To ensure timely repayment, project financiers carefully assess the project’s cash flow projections. These projections forecast the expected inflows and outflows of funds over a specific period, allowing project developers to plan repayment schedules accordingly.

In addition to monitoring cash inflows from the revenue stream, project developers must account for operating expenses, debt servicing, and other project-related costs. By analyzing the project’s net cash flow, financiers can assess the project’s ability to generate sufficient funds to cover its expenses and meet repayment obligations.

It is important to note that project debt refers to the borrowed capital used to finance the project’s development or construction. Repayment of this debt typically relies on the project’s cash flow rather than the borrower’s general assets or balance sheet.

Project financiers carefully evaluate the project’s cash flow projections to assess the financial feasibility of the project and determine whether it can generate sufficient funds to meet repayment requirements.

By understanding the vital role of cash flow in project finance and effectively managing it, project stakeholders can ensure the timely repayment of project debt to creditors, thereby maintaining the trust and confidence of financial institutions and fostering future investment opportunities.

Types of Project Finance

In project finance, different financing options are available to meet the specific needs of a project. These options include recourse, non-recourse, and limited recourse financing, as well as off-balance-sheet financing. Understanding the characteristics and advantages of each type is crucial for project stakeholders.

Recourse Financing

Recourse financing is a type of project finance where lenders have the right to seek recourse from the project sponsor if the project fails to generate sufficient cash flow for debt repayment. This means that the lender can pursue the project sponsor’s other assets to recover the outstanding debt.

Non-Recourse Financing

Non-recourse financing, on the other hand, limits the lender’s recourse only to the project itself. In this financing structure, the lender’s ability to recover funds is tied solely to the project’s cash flows and assets. If the project fails, the lender cannot seek additional compensation from the project sponsor’s other assets.

Limited Recourse Financing

Limited recourse financing is a hybrid between recourse and non-recourse financing. In this structure, lenders have limited recourse to the project sponsor’s other assets, usually restricted to a certain percentage or value. This provides additional protection to the project sponsor while still providing lenders with some recourse in the event of default.

Off-Balance-Sheet Financing

Off-balance-sheet financing is a technique used to keep certain assets and liabilities off the company’s balance sheet. This allows the company to present a stronger financial position and minimize risk. In project finance, off-balance-sheet financing often involves the creation of special purpose vehicles (SPVs) to hold and manage project assets and liabilities.

Each type of project finance has its advantages and considerations. Recourse financing offers lenders greater security, while non-recourse financing limits the project sponsor’s liability. Limited recourse financing provides a balance between the two, and off-balance-sheet financing can help manage risk and improve financial position. The choice of financing type depends on the specific project requirements, risk appetite, and stakeholders’ preferences.

| Type | Advantages | Considerations |

|---|---|---|

| Recourse Financing | Greater security for lenders | Potential liability for project sponsor |

| Non-Recourse Financing | Limits project sponsor’s liability | Higher perceived risk for lenders |

| Limited Recourse Financing | Balance between security and limited liability | May require negotiation between parties |

| Off-Balance-Sheet Financing | Improved financial position and risk management | Complexity in managing special purpose vehicles |

Project Finance Structure

When it comes to project finance, the structure plays a crucial role in ensuring the success and viability of a project. One key component of this structure is the use of special purpose vehicles (SPVs). An SPV is a legal entity created specifically for a particular project, allowing for better risk management and segregation of project assets and liabilities.

Financial modeling is another essential aspect of project finance structure. It involves creating mathematical models that simulate the project’s financial performance under different scenarios. By analyzing variables such as capital costs, operating expenses, and revenue projections, financial modeling helps evaluate the project’s financial feasibility and potential risks.

One of the critical factors considered in project finance structure is project cash flow. Cash flow refers to the movement of funds in and out of the project throughout its lifecycle. It includes various sources of revenue, such as project income, government grants, and financing proceeds. Project cash flow analysis helps assess the project’s ability to generate sufficient cash inflows to cover operating costs, debt repayments, and provide adequate returns to investors.

Financial modeling enables project stakeholders to assess the impact of different financial variables on project cash flow, identify potential risks, and develop strategies to mitigate them. It provides valuable insights into the project’s financial viability and assists in making informed investment decisions.

To visualize the interplay between project finance structure, financial modeling, and project cash flow, refer to the following table:

| Project Finance Structure Components | Benefits |

|---|---|

| Special Purpose Vehicles (SPVs) | Allows for efficient risk management and asset segregation. |

| Financial Modeling | Helps evaluate project feasibility, identify risks, and optimize financial outcomes. |

| Project Cash Flow | Assesses the project’s ability to generate sufficient funds for operating costs, debt repayment, and investor returns. |

By implementing a robust project finance structure, utilizing special purpose vehicles, performing comprehensive financial modeling, and closely monitoring project cash flow, stakeholders can enhance the chances of project success and achieve the desired financial outcomes.

Project Finance vs. Corporate Finance

When it comes to financing large-scale projects, two key approaches are commonly used: project finance and corporate finance. While both methods are designed to secure funding, there are significant differences between them. In this section, we will explore these differences and highlight the unique attributes of each.

Financial Statements and the Balance Sheet:

One of the primary distinctions between project finance and corporate finance lies in the way financial statements are structured and utilized. In corporate finance, financial statements provide a holistic view of a company’s operations, assets, and liabilities. The balance sheet, in particular, showcases the company’s financial standing at a specific point in time, highlighting its assets, liabilities, and equity.

In contrast, project finance relies heavily on the financial statements of individual projects. Within this framework, project-level financial statements take center stage, aiming to evaluate the feasibility, profitability, and risks associated with specific ventures. Consequently, these financial statements play a crucial role in determining the project’s ability to attract investors and secure funding.

Comparing Funding Structures:

Another significant difference between project finance and corporate finance is the funding structure. In corporate finance, funding is typically sourced through a combination of debt and equity, allowing companies to balance risk and ownership. This approach allows corporations to leverage their balance sheets and distribute investment risk among various stakeholders.

Also Read:- Exploring Trends in Future Finance & Investment

In contrast, project finance often relies heavily on non-recourse or limited recourse financing. Non-recourse financing means that lenders have limited claim to the project’s assets and cash flows, reducing the risk for project sponsors. Limited recourse financing, on the other hand, grants lenders recourse to specific project assets and cash flows, providing a moderate level of security. These structures are implemented to mitigate risks associated with long-term and capital-intensive projects.

Implications for Stakeholders:

The distinction between project finance and corporate finance has implications for various stakeholders involved. In corporate finance, the responsibility for managing risks and generating profits lies primarily with the company itself, as well as its shareholders and lenders. On the other hand, project finance distributes risks and rewards among a broader network of stakeholders, including investors, lenders, contractors, and the project company.

Overall, project finance and corporate finance approaches address different funding needs and risk profiles. While corporate finance focuses on the financial performance of an entire company, project finance dives deep into the financial specifics of individual ventures. Recognizing these distinctions is essential for decision-makers, as it enables them to select the appropriate financing method for their specific projects and optimize their chances of success.

| Project Finance | Corporate Finance |

|---|---|

| Financial statements focus on project-level performance | Financial statements provide a holistic view of the company |

| Reliance on non-recourse or limited recourse financing | Combination of debt and equity financing |

| Shares risks and rewards among wider stakeholder network | Primary responsibility lies with the company and its shareholders |

Risks Associated with Project Finance

Project finance comes with its fair share of risks and challenges that need to be carefully considered and managed. Understanding these risks is crucial for the successful completion of long-term projects, especially during the construction phase. Additionally, identifying funding needs and implementing strategies to meet those needs is essential for the smooth execution of the project.

Project Risk

One of the primary risks in project finance is project risk itself. Projects, particularly those in emerging markets, face various uncertainties such as political instability, regulatory changes, and economic fluctuations. These risks can significantly impact the project’s financial feasibility and overall success. Therefore, thorough risk assessment and contingency planning should be carried out to mitigate project risk.

Long-Term Projects

Another risk associated with project finance is the long-term nature of these projects. The extended duration increases the likelihood of encountering unforeseen challenges and changes in market dynamics. It is crucial to consider the potential impact of changing economic conditions, technological advancements, and environmental factors over the project’s lifespan. Adapting to these long-term implications is essential for project sustainability.

Construction Phase

The construction phase poses specific risks in project finance. Delays, cost overruns, and quality issues are common challenges that can hinder project progress and increase expenses. Managing contractors, ensuring compliance with regulations, and maintaining effective communication among stakeholders are critical during this phase. Implementing robust project management practices helps minimize these risks and ensures timely completion of construction.

Funding Needs

Adequate funding is essential for successful project completion. Insufficient or delayed funding can jeopardize the timely execution of the project, leading to significant setbacks and financial losses. It is crucial to accurately assess the funding needs at each stage of the project and establish appropriate financing arrangements. Having a comprehensive understanding of the project’s financial requirements enables better planning and contingency preparations.

“By understanding and effectively managing the risks associated with project finance, stakeholders can enhance the chances of project success and minimize potential disruptions.”

The risks associated with project finance demand thorough analysis, meticulous planning, and proactive risk management. By identifying project risks, acknowledging the long-term project considerations, addressing challenges during the construction phase, and ensuring adequate funding, stakeholders can enhance project feasibility and increase the likelihood of successful project completion.

| Common Risks in Project Finance | Impact | Preventive Measures |

|---|---|---|

| Project Risk | Potentially derails the project and impacts financial feasibility | Thorough risk assessment, contingency planning, and adapting to changing conditions |

| Long-Term Projects | Exposure to evolving market dynamics and unforeseen challenges | Consideration of long-term implications and adaptability to changing conditions |

| Construction Phase | Delays, cost overruns, and quality issues impacting project progress | Effective project management, compliance monitoring, and stakeholder communication |

| Funding Needs | Insufficient or delayed funding hampering project execution | Accurate assessment of funding requirements and appropriate financing arrangements |

Image: Managing risks in project finance is crucial for the successful completion of long-term projects.

Funding Methods in Project Finance

In project finance, the choice of funding methods plays a crucial role in determining the financial viability of a project. Two common funding methods used in project finance are debt and equity financing. Let’s explore these methods in detail:

Debt Financing

Debt financing involves raising funds through borrowing, where the borrower agrees to repay the principal amount along with interest over a specified period of time. This method is commonly used in project finance to secure a significant portion of the required capital. Debt financing offers several advantages, such as:

- Access to large amounts of capital

- Lowering the overall cost of capital

- Preserving ownership control

However, it is important to carefully assess the debt service coverage ratio and project cash flow to ensure the project’s ability to meet debt repayment obligations.

Equity Financing

Equity financing involves raising funds by selling ownership stakes in the project to investors. In return, investors receive a share of the project’s profits and have a say in its decision-making process. Equity financing offers several advantages, including:

- Sharing financial risk between investors and project sponsors

- Access to expertise and networks from equity investors

- Potential for higher returns on investment

Equity financing is particularly beneficial for projects with uncertain cash flows or higher risk profiles. However, it may result in the dilution of ownership control for project sponsors.

Structured Financing Options

Besides debt and equity financing, project finance also utilizes structured financing options to allocate risks and enhance financial feasibility. Two common structured financing options are take-or-pay and off-take agreements.

Take-or-Pay Agreements: A take-or-pay agreement is a contractual arrangement where a buyer agrees to purchase the specified amount of a product or service from the project, regardless of whether they actually require it. This provides stability to the project’s cash flow and reduces the risk of underutilization.

Off-Take Agreements: An off-take agreement is a long-term contract between the project company and a buyer for the purchase of the project’s output. This ensures a steady revenue stream for the project and mitigates the risk of unsold products or services.

Both take-or-pay and off-take agreements are commonly used in industries such as energy, mining, and manufacturing, where revenue stability is crucial for the project’s financial success.

| Funding Method | Advantages | Considerations |

|---|---|---|

| Debt Financing |

|

|

| Equity Financing |

|

|

| Structured Financing |

|

|

Project Finance in Emerging Markets

When it comes to financing large-scale infrastructure projects in emerging markets, project finance plays a crucial role. These markets offer abundant opportunities for investment, but they also come with unique challenges and considerations. In this section, we will explore the complexities of project finance in emerging markets, with a specific focus on procurement and construction.

Emerging markets, such as Brazil, India, and China, are experiencing rapid economic growth and urbanization, necessitating substantial investments in infrastructure development. However, one of the main obstacles these markets face is limited access to traditional funding sources. This is where project finance steps in, providing an alternative approach that attracts both domestic and international investors.

Infrastructure projects in emerging markets often require significant capital, making project finance an attractive option due to its ability to leverage various funding sources. In addition to securing loans from banks and financial institutions, project sponsors can explore alternative financing options, such as public-private partnerships (PPPs) or international development agencies.

However, financing infrastructure projects in emerging markets is not without its challenges. Limited regulatory frameworks, political instability, and unfamiliar legal environments can impact the success of project finance initiatives. Additionally, these markets often lack well-established procurement processes, making it essential for investors to carefully assess the risks and opportunities.

“Infrastructure development in emerging markets presents immense opportunities for investors seeking long-term returns. However, a thorough understanding of the local context, including procurement and construction considerations, is vital for successful project finance.”

To navigate the complexities of project finance in emerging markets, stakeholders need to collaborate closely with local authorities, contractors, and suppliers. Successful partnerships can help mitigate risks and ensure the timely completion of infrastructure projects.

Procurement and Construction Challenges

When it comes to infrastructure projects in emerging markets, the procurement and construction phases are often critical and require careful attention. Challenges such as corruption, inadequate project management, and limited technological capabilities can impact project timelines and budgets.

Effective procurement strategies that promote transparency, competition, and fairness are crucial for mitigating these challenges. Furthermore, implementing robust risk management practices and conducting thorough due diligence during the construction phase can contribute to project success.

By addressing these challenges head-on, project finance can play a significant role in driving economic growth, improving living standards, and meeting the infrastructure needs of emerging markets.

Case Studies in Project Finance

In this section, we present case studies that highlight successful project finance examples in various industries, such as infrastructure financing, power purchase agreements, and oil and gas projects. These case studies illustrate the effectiveness of project finance in driving large-scale infrastructure development and driving economic growth.

Case Study 1: Infrastructure Financing

One notable case is the Panama Canal Expansion Project, which involved the construction of new locks and widening of existing channels to accommodate larger vessels. The financing for this ambitious infrastructure project, estimated at $5.25 billion, was secured through a combination of public and private funds, including loans from international financial institutions and private investors. The project’s success in attracting diverse sources of funding demonstrates the viability of project finance in funding complex infrastructure initiatives.

Case Study 2: Power Purchase Agreement

The Kerala Renewable Energy Project in India showcases the effectiveness of project finance in renewable energy development. The project involved the installation of solar power plants across the state of Kerala. To ensure the project’s financial feasibility, a power purchase agreement (PPA) was established between the project company and the state electricity board, guaranteeing the purchase of electricity at favorable rates. The PPA provided the necessary revenue certainty to secure project financing and accelerate the implementation of renewable energy infrastructure.

Case Study 3: Oil and Gas Project

The Shah Deniz Gas Field Development in Azerbaijan serves as an example of successful project finance in the oil and gas industry. This project aimed to tap into the country’s vast gas reserves and establish Azerbaijan as a major supplier of natural gas to Europe. The financing for the project was structured through a consortium of international lenders and involved the use of forward gas sales agreements to secure revenue streams. The successful implementation of project finance enabled the timely completion of the project and the realization of substantial economic benefits.

These case studies demonstrate the flexibility and effectiveness of project finance in different sectors. Whether it’s financing infrastructure projects, securing power purchase agreements, or funding oil and gas ventures, project finance is a proven tool for driving economic development and achieving ambitious goals.

Conclusion

In conclusion, project finance offers a valuable funding option for large-scale infrastructure and industrial projects. It allows businesses and governments to access the necessary capital without putting excessive strain on their balance sheets. By considering various funding options, such as debt and equity, project finance provides flexibility in meeting the financial needs of diverse projects.

A crucial aspect of project finance is conducting a comprehensive risk assessment. Identifying and mitigating potential risks early on can significantly increase the chances of project success. Additionally, financial feasibility analysis plays a critical role in determining the viability of a project. It helps stakeholders assess the project’s financial viability, cash flow projections, and potential return on investment.

When it comes to project finance, making informed decisions regarding funding options and risk assessment is essential. By understanding the intricacies of project finance and conducting thorough financial analysis, businesses and governments can ensure successful project execution, promote sustainable development, and drive economic growth.

FAQs

Q: What is project finance?

A: Project finance is a financing arrangement used to fund projects, where the lenders look primarily to the revenues generated by the project for the repayment of their loans.

Q: What are off-balance sheet financing arrangements?

A: Off-balance sheet financing refers to a form of financing where a new project is structured in a way that keeps it off the project sponsor’s balance sheet. This can be achieved through various legal and financial structuring methods.

Q: How do development banks play a role in project finance?

A: Development banks often provide funding sources for major projects in emerging markets. They offer financial support in the form of loans, guarantees, and technical assistance to promote economic development.

Q: What are non-recourse loans in project finance?

A: Non-recourse loans are a type of loan agreement where the lender can only look to the project’s assets for repayment, not to the project sponsors’ other assets or income. This reduces the risk for the sponsors in case the project fails.

Q: What is the role of finance corporations in project finance?

A: Finance corporations are institutions that provide financing for both project and corporate finance. They play a crucial role in structuring financial solutions for various projects, depending on the type and scale of the project.

Q: What are the challenges faced in project finance in emerging markets?

A: Project finance in emerging markets can face challenges such as uncertain government policies, currency risks, lack of infrastructure, and political instability. These factors can impact the funding sources and terms and conditions of financing arrangements.

Q: How are infrastructure sectors financed using project finance?

A: Infrastructure sectors, such as energy, transportation, and telecommunications, often rely on project finance to fund large infrastructure projects. This involves securing funding from various sources, including government support, development banks, and private investors.